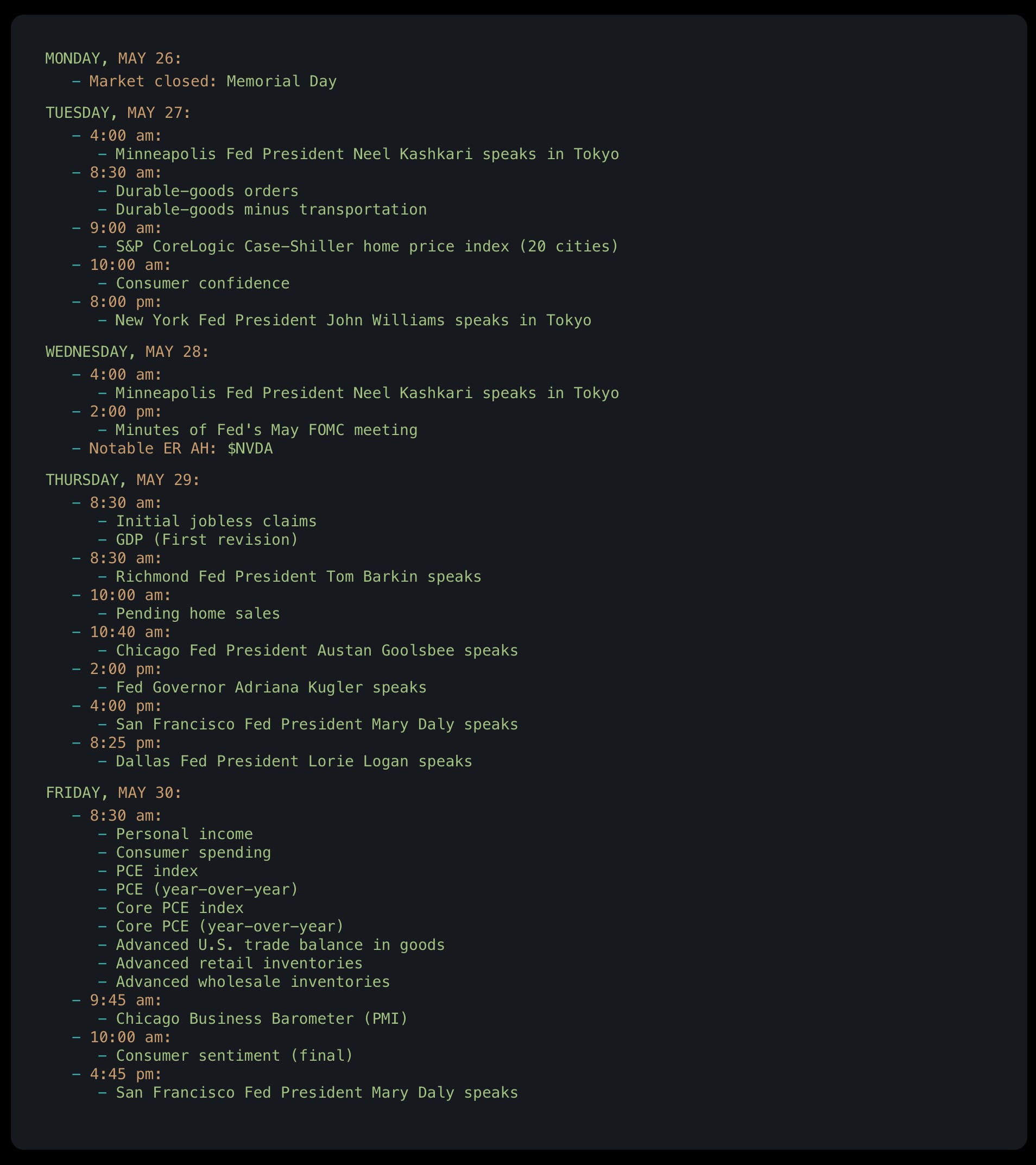

Weekly market calendar: May 26-30, 2025

Hey traders,

Here’s what’s on the radar for this week’s market events:

The beauty of writing and publishing these notes weekly is that we get to go back and compare our forecasts, tracking where we stand week by week.

Last weekend, we posted our downside PTs for $SPX:

We’re getting pretty close to our first target: the gap at 5720.

Right now, we see $DIA accelerating its downside momentum, closing Friday just above its 20-day SMA on higher volume — which gives us clues that more downside may be coming. Add to that the fact that $QQQ and $SPY aren’t even at their own 20-day SMAs yet, so there’s clearly room for some continuation.

The big index ETF trio combining with more fuel for downside left

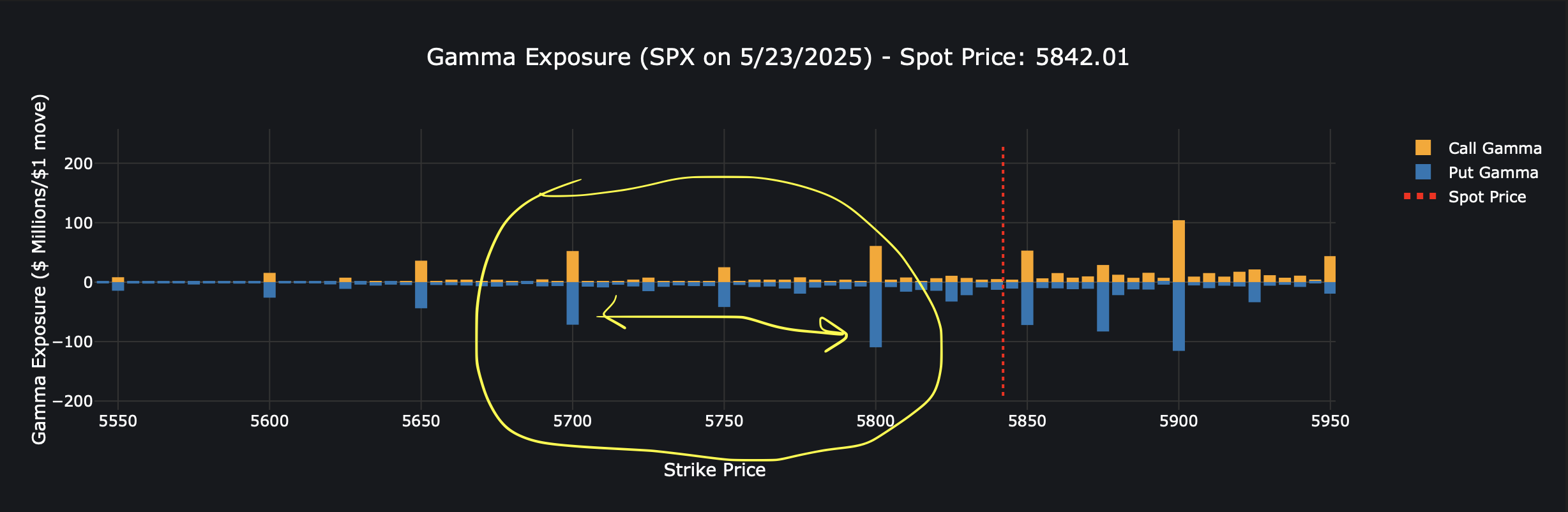

Per 0DTHERO, looking at the gamma exposure for $SPX, there’s clearly not much support from 5800 down to 5700, which makes the gap fill scenario more compelling.

And just to stack the confirmations: the leftover flows on both $SPY and $QQQ from Friday may be setting up more dealer selling — which would apply even more downside pressure to markets.

Tomorrow is Memorial Day, and markets are closed as we take time to honor and remember those who paid the ultimate sacrifice while serving our great nation.

Let’s have a great week.