Using 0DTHERO flow to trigger Futures trades

Let’s walk through the trade I took this morning, triggered entirely by 0DTHERO flow signals.

Right from the open, $SPX flow wanted nothing to do with upside — diverging from $ES price action. That’s what we call slope divergence between flow and price.

On $SPY, the setup looked a little different. All-expiration flow led the upside seen on $ES.

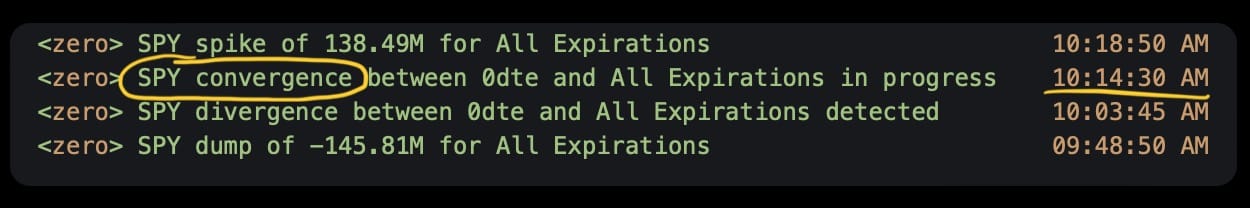

When All-expiration and 0DTE flows start to separate from each other, we call it flow divergence.

Not to be confused with slope divergence, which includes price — flow divergence is flow-only.

When I saw those two signals

1) Slope divergence between $SPX flow and price

2) Positive flow divergence on $SPY leading price —

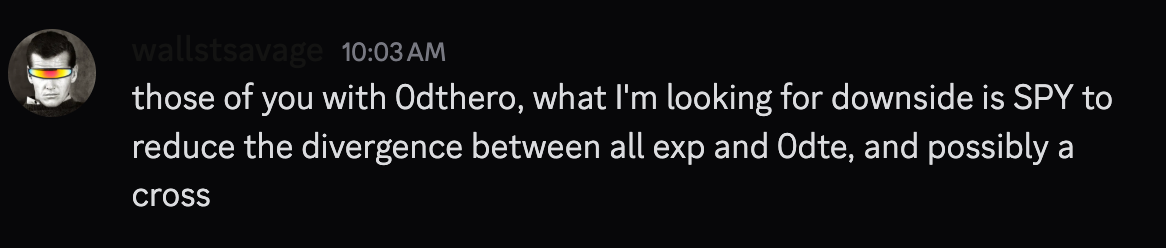

I knew there was a good chance for a reversal. I dropped a note in Discord with what I was watching for before entering a position myself.

What I wanted to see next was convergence followed by a flow cross — $SPY flow aligning and giving me multiple points of confirmation on the price reversal.

At around 10:40 AM, that’s exactly what we got.

We’re in shorts.

Watching how $SPY behaved during the initial $ES dump — with that negative divergence followed by convergence — told me downside was most likely limited.

No need to expect more than what was given.

Great trade to start FOMC day.

Flow doesn’t wait — and neither should you.

Try 0DTHERO free for 7 days and trade with real-time edge → 0dthero.com