Morning Market Notes 05-20-25

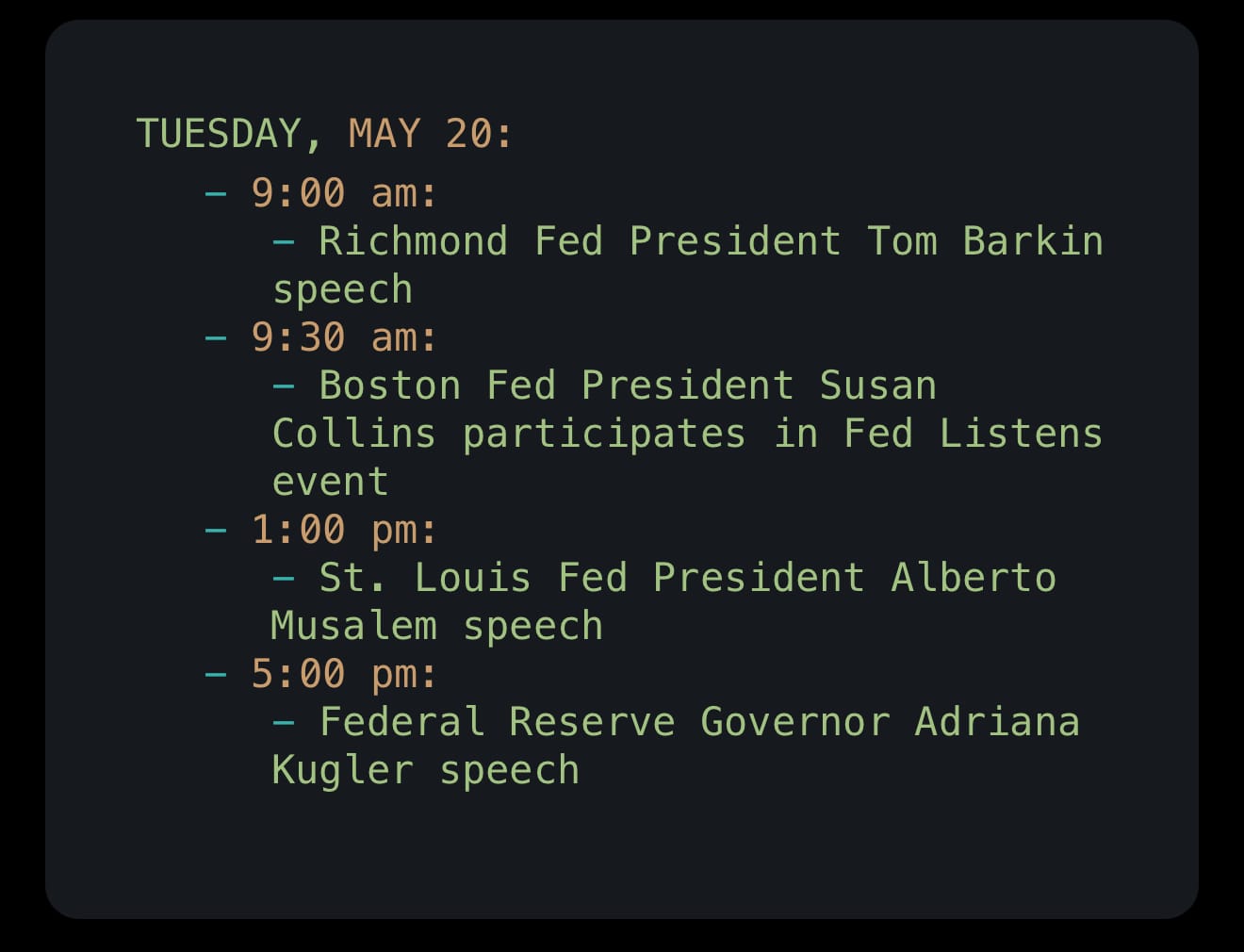

Market Calendar

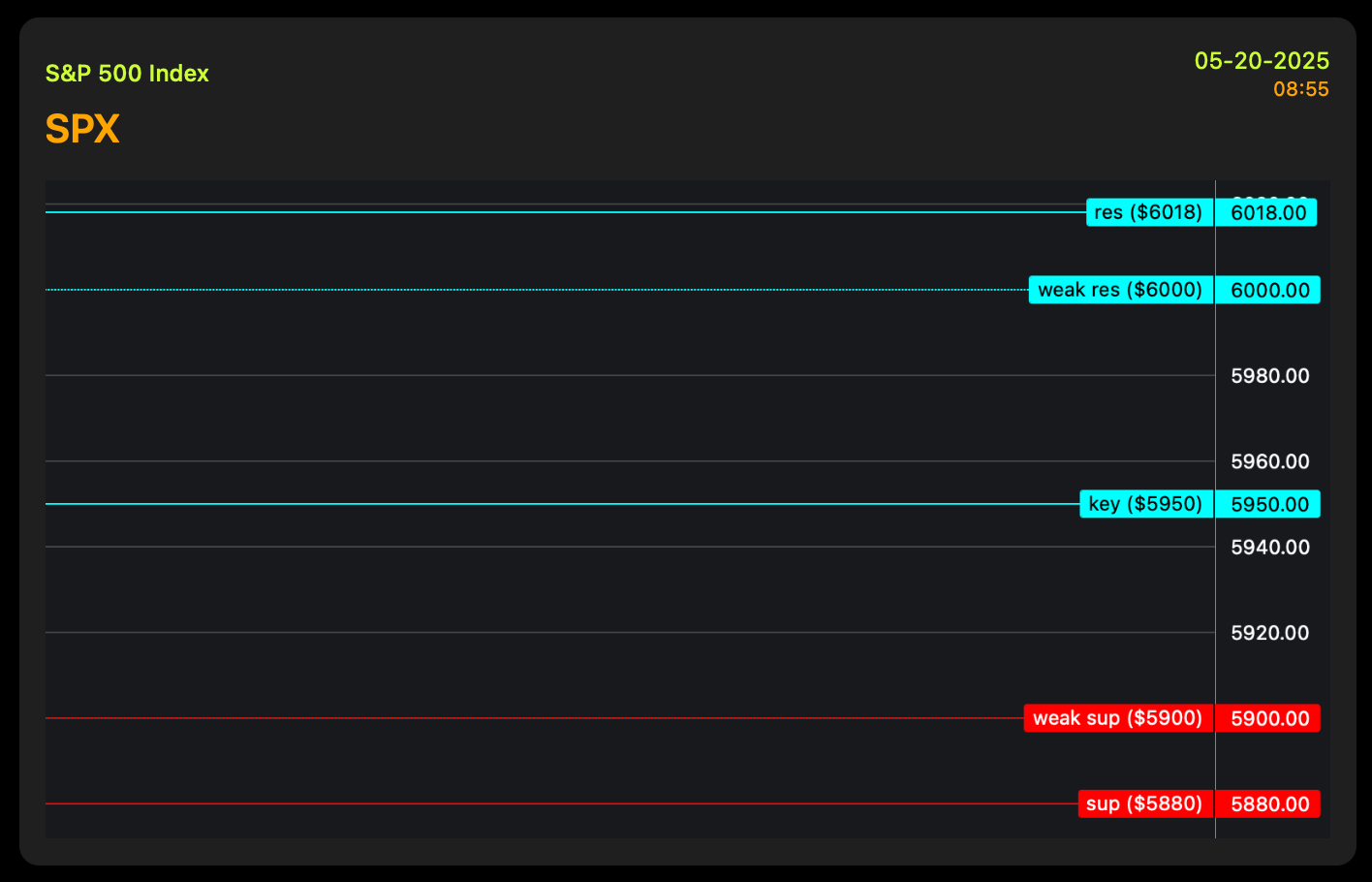

$SPX & $QQQ

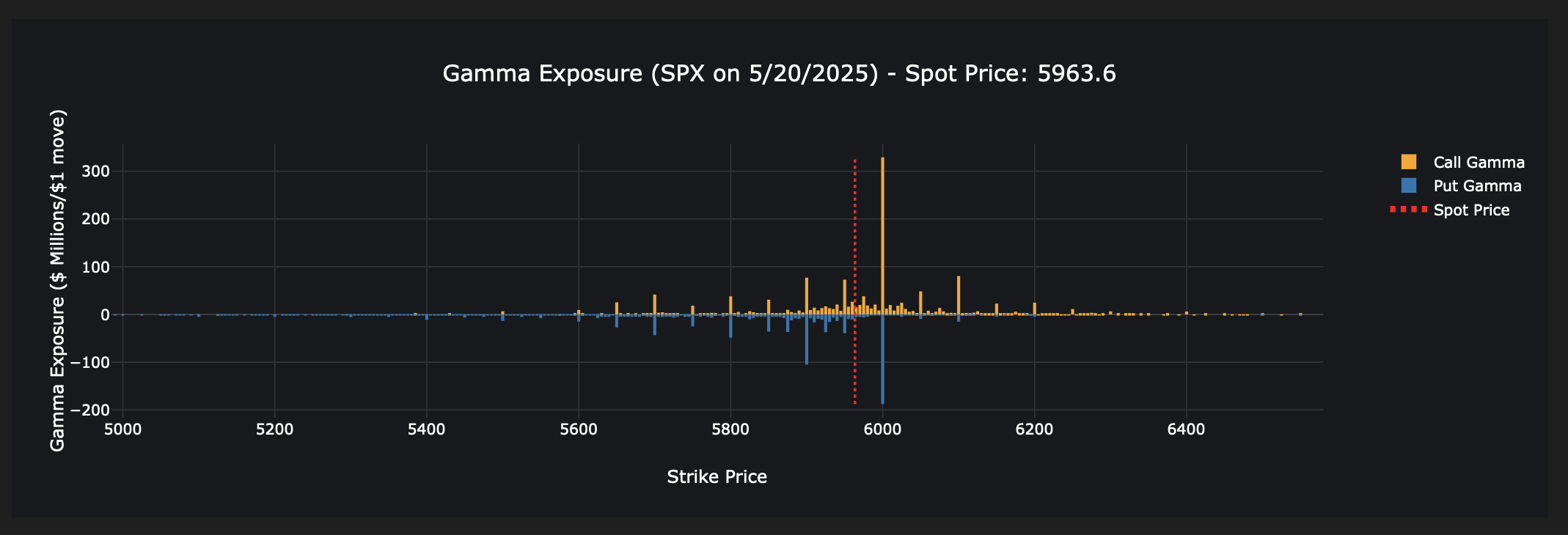

We’ve been talking about the 5900–6000 $SPX range, but that was before the big OPEX last Friday.

Now, all that matters in the gamma exposure landscape is 6000 — the major resistance and call wall.

The S&P keeps inching closer to it, and we’re sticking to our view that we’ll see downside from there in the upcoming weeks or months.

Yesterday, $QQQ gave us the first technical sell signal among the major index ETFs — now we wait for $SPY and $DIA to confirm.

Let’s have a sesh.

Using 0DTHERO flow to trigger Futures trades

Let’s walk through the trade I took this morning, triggered entirely by 0DTHERO flow signals. Right from the open, $SPX flow wanted nothing to do with upside — diverging from $ES price action. That’s what we call slope divergence between flow and price. On $SPY, the setup looked a